Instant Download

Get Reseller Access

After Sale Support

Limited Time Offer

৳ 550 Original price was: ৳ 550.৳ 350Current price is: ৳ 350.

Any US Bank Account Method in Bangla

Instant Download

Get Reseller Access

After Sale Support

Limited Time Offer

৳ 550 Original price was: ৳ 550.৳ 350Current price is: ৳ 350.

৳ 550 Original price was: ৳ 550.৳ 350Current price is: ৳ 350.

যেভাবে অর্ডার করবেন:

Description

How to Apply for a U.S. Bank Account: Step-by-Step Guide

You can conveniently apply for a bank account in the U.S., and enjoy safe savings facilities and other online banking services. If you are a U.S. citizen or not, learn everything today about opening an account in the USA including which documents to present and how its step by step works into your routine! How to Apply for a U.S. Bank Account

Why Open a U.S. Bank Account?

There are many advantages that come with having a U.S. bank account, particularly if you travel to or have business in the United States often. It makes transfers smoother, often comes with competitive rates and exchange costs on currency transactions,and will even start to establish a financial history if you are a resident or planning to be in the future.

Benefits of a U.S. Bank Account Include:

- Secure Transactions: Protection of funds through FDIC insurance and modern security protocols.

- Access to U.S. Credit System: Important for residents who want to build a U.S. credit history.

- Efficient International Payments: Allows for faster and less expensive transfers for international customers.

Types of Bank Accounts Available

- Checking Account: Ideal for everyday transactions, such as depositing paychecks and making purchases. These accounts usually come with a debit card and check-writing privileges.

- Savings Account: Allows account holders to earn interest on their deposits. Often used for storing money over the long term, it has a limit on the number of monthly withdrawals.

- Certificate of Deposit (CD): Higher interest rates but requires you to leave your money untouched for a specified period.

Requirements for Opening a U.S. Bank Account

There are prerequisites on How to Open a U.S. Bank Account The documentation is different for U.S. citizens, residents, and non-residents with a visa.

Common Documentation for U.S. Residents

- Government-issued ID: Such as a driver’s license or passport.

- Social Security Number (SSN): This is crucial for identity verification and tax purposes.

- Proof of Address: Utility bills or rental agreements are generally accepted.

Common Documentation for Non-Residents

- Passport: Essential for identity verification.

- Visa or Other U.S. Entry Documentation: Shows your legal status in the U.S.

- ITIN (Individual Taxpayer Identification Number): Needed if you do not have an SSN.

- Proof of Foreign Address: Required by some banks.

Note: Not all U.S. banks accept non-residents, so be sure to check bank-specific requirements.

Steps to Apply for a U.S. Bank Account

1. Research and Compare Banks

Consider banks that offer accounts to your residency status, shop around account fees and look at interest rates.

2. Gather Required Documents

You will need to have proof of ID, address and tax id number (SSN or ITIN)

3. Choose Your Account Type

Choose between a checking, savings or another type of account depending on your financial goals.

4. Apply Online or In-Branch

Most banks today allow for online applications, especially if you are a U.S. resident. For non-residents, in-person application may be necessary. The whole process usually only takes a few minutes although verification can take up to 2 business days.

5. Deposit Initial Funds

Most banks will require a minimum deposit, which can vary anywhere from $25 up to$100 This can usually be completed as an online or in-person initial deposit.

6. Account verification and access to online banking

After your account is approved, a banking set-up will be put in place as you access bank statements and view records of transactions to manage all funds online.

Applying as a Non-Resident

They should also check which banks open accounts for foreigners as well, to ensure the process will be successful if they decide on opening one.

Some popular banks that are known for accommodating non-residents include Wells Fargo, Citibank, and HSBC.

Tips for Non-Resident Applicants:

- Prepare for In-Person Visits: Many U.S. banks require non-residents to apply in-branch.

- Obtain an ITIN: While an SSN is typically not available to non-residents, an ITIN serves as an alternative for tax and identification purposes.

Top U.S. Banks for Non-Residents and Residents

Here are some banks that offer convenient account options for U.S. residents and international customers:

- Chase Bank

- Offers comprehensive banking services, including checking and savings accounts.

- Known for a vast ATM network and mobile banking options.

- Bank of America

- Popular for its accessibility and robust online services.

- Offers accounts with low minimum deposits and extensive customer support.

- Wells Fargo

- Provides easy account management and international-friendly services.

- Well-known for its extensive physical branch network.

- HSBC

- Known for international banking options that cater to non-U.S. residents.

- Offers checking and savings accounts specifically for international customers.

- Citibank

- Caters to both U.S. residents and non-residents with a variety of account options.

- Known for its extensive global reach, making it easier for international clients to manage their finances.

Final Thoughts

A U.S. bank account can help you manage your finances for personal savings or day-to-day transactions — and in many cases making money between international accounts easier! Following the steps mentioned in this guide and making sure you have all your documents together can help fast forward the application process, prevent a freeze on your funds, and also open up many services that U.S. banks provide powered by Temenos vsi sdk better than others!

Q & A

Related Products

Items You May Like

Discover recommended products that complement your interests and enhance your shopping experience.

Description

How to Apply for a U.S. Bank Account: Step-by-Step Guide

You can conveniently apply for a bank account in the U.S., and enjoy safe savings facilities and other online banking services. If you are a U.S. citizen or not, learn everything today about opening an account in the USA including which documents to present and how its step by step works into your routine! How to Apply for a U.S. Bank Account

Why Open a U.S. Bank Account?

There are many advantages that come with having a U.S. bank account, particularly if you travel to or have business in the United States often. It makes transfers smoother, often comes with competitive rates and exchange costs on currency transactions,and will even start to establish a financial history if you are a resident or planning to be in the future.

Benefits of a U.S. Bank Account Include:

- Secure Transactions: Protection of funds through FDIC insurance and modern security protocols.

- Access to U.S. Credit System: Important for residents who want to build a U.S. credit history.

- Efficient International Payments: Allows for faster and less expensive transfers for international customers.

Types of Bank Accounts Available

- Checking Account: Ideal for everyday transactions, such as depositing paychecks and making purchases. These accounts usually come with a debit card and check-writing privileges.

- Savings Account: Allows account holders to earn interest on their deposits. Often used for storing money over the long term, it has a limit on the number of monthly withdrawals.

- Certificate of Deposit (CD): Higher interest rates but requires you to leave your money untouched for a specified period.

Requirements for Opening a U.S. Bank Account

There are prerequisites on How to Open a U.S. Bank Account The documentation is different for U.S. citizens, residents, and non-residents with a visa.

Common Documentation for U.S. Residents

- Government-issued ID: Such as a driver’s license or passport.

- Social Security Number (SSN): This is crucial for identity verification and tax purposes.

- Proof of Address: Utility bills or rental agreements are generally accepted.

Common Documentation for Non-Residents

- Passport: Essential for identity verification.

- Visa or Other U.S. Entry Documentation: Shows your legal status in the U.S.

- ITIN (Individual Taxpayer Identification Number): Needed if you do not have an SSN.

- Proof of Foreign Address: Required by some banks.

Note: Not all U.S. banks accept non-residents, so be sure to check bank-specific requirements.

Steps to Apply for a U.S. Bank Account

1. Research and Compare Banks

Consider banks that offer accounts to your residency status, shop around account fees and look at interest rates.

2. Gather Required Documents

You will need to have proof of ID, address and tax id number (SSN or ITIN)

3. Choose Your Account Type

Choose between a checking, savings or another type of account depending on your financial goals.

4. Apply Online or In-Branch

Most banks today allow for online applications, especially if you are a U.S. resident. For non-residents, in-person application may be necessary. The whole process usually only takes a few minutes although verification can take up to 2 business days.

5. Deposit Initial Funds

Most banks will require a minimum deposit, which can vary anywhere from $25 up to$100 This can usually be completed as an online or in-person initial deposit.

6. Account verification and access to online banking

After your account is approved, a banking set-up will be put in place as you access bank statements and view records of transactions to manage all funds online.

Applying as a Non-Resident

They should also check which banks open accounts for foreigners as well, to ensure the process will be successful if they decide on opening one.

Some popular banks that are known for accommodating non-residents include Wells Fargo, Citibank, and HSBC.

Tips for Non-Resident Applicants:

- Prepare for In-Person Visits: Many U.S. banks require non-residents to apply in-branch.

- Obtain an ITIN: While an SSN is typically not available to non-residents, an ITIN serves as an alternative for tax and identification purposes.

Top U.S. Banks for Non-Residents and Residents

Here are some banks that offer convenient account options for U.S. residents and international customers:

- Chase Bank

- Offers comprehensive banking services, including checking and savings accounts.

- Known for a vast ATM network and mobile banking options.

- Bank of America

- Popular for its accessibility and robust online services.

- Offers accounts with low minimum deposits and extensive customer support.

- Wells Fargo

- Provides easy account management and international-friendly services.

- Well-known for its extensive physical branch network.

- HSBC

- Known for international banking options that cater to non-U.S. residents.

- Offers checking and savings accounts specifically for international customers.

- Citibank

- Caters to both U.S. residents and non-residents with a variety of account options.

- Known for its extensive global reach, making it easier for international clients to manage their finances.

Final Thoughts

A U.S. bank account can help you manage your finances for personal savings or day-to-day transactions — and in many cases making money between international accounts easier! Following the steps mentioned in this guide and making sure you have all your documents together can help fast forward the application process, prevent a freeze on your funds, and also open up many services that U.S. banks provide powered by Temenos vsi sdk better than others!

Reviews

There are no reviews yet

Q & A

Additional information

-

Sale!

capcut pro+video editing file

৳ 399Original price was: ৳ 399.৳ 99Current price is: ৳ 99. Add to cart -

Sale!

ই-কমার্স মাস্টারমাইন্ড

৳ 990Original price was: ৳ 990.৳ 99Current price is: ৳ 99. Add to cart -

Sale!

Digital marketing with buyer finding full course|ঘরে বসে ডিজিটাল মার্কেটিং শিখুন

৳ 5,000Original price was: ৳ 5,000.৳ 190Current price is: ৳ 190. Add to cart -

Sale!

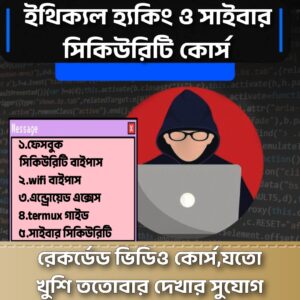

ইথিক্যল হ্যকিং ও সাইবার সিকিউরিটি কোর্স

৳ 4,000Original price was: ৳ 4,000.৳ 190Current price is: ৳ 190. Add to cart -

Sale!

(300+45) Landing page combo

৳ 1,100Original price was: ৳ 1,100.৳ 450Current price is: ৳ 450. Add to cart -

Sale!

ইসলামিক রিল ভিডিও

৳ 299Original price was: ৳ 299.৳ 95Current price is: ৳ 95. Add to cart -

Sale!

কিভাবে ফেসবুক Blue Verification Badge মাত্র ৩০০ টাকাই নিবেন

৳ 699Original price was: ৳ 699.৳ 490Current price is: ৳ 490. Add to cart -

Sale!

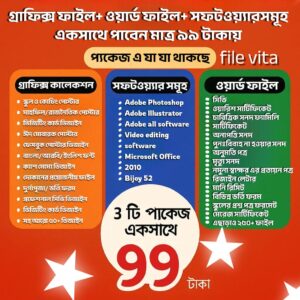

পুরো গ্রাফিক্স ফাইল সহ সবগুলো ফাইল মাত্র ৯৯ টাকা

৳ 499Original price was: ৳ 499.৳ 99Current price is: ৳ 99. Add to cart -

Sale!

৯টি প্রিমিয়াম সার্ভিস – সব প্রয়োজনের একমাত্র সমাধান!

৳ 1,990Original price was: ৳ 1,990.৳ 499Current price is: ৳ 499. Add to cart -

Sale!

৫০,০০০+ AI Reels ভিডিও প্যাকেজ(কপিরাইট ফ্রি)

৳ 499Original price was: ৳ 499.৳ 99Current price is: ৳ 99. Add to cart -

Sale!

55+ Laravel Script Collection for IT Businesses

৳ 999Original price was: ৳ 999.৳ 499Current price is: ৳ 499. Add to cart -

Sale!

Social Media Thumbnail Pro Course 🚀

৳ 550Original price was: ৳ 550.৳ 99Current price is: ৳ 99. Add to cart -

Sale!

WP Lead Capturing Pages – WordPress Plugin

৳ 650Original price was: ৳ 650.৳ 450Current price is: ৳ 450. Add to cart -

Sale!

WP Featured News Pro | Custom Posts Listing Plugin

৳ 650Original price was: ৳ 650.৳ 450Current price is: ৳ 450. Add to cart -

Sale!

BizReview – Business Review WordPress Plugin

৳ 650Original price was: ৳ 650.৳ 450Current price is: ৳ 450. Add to cart -

Sale!

Mega Posts and Custom Posts Display WP Plugin

৳ 650Original price was: ৳ 650.৳ 450Current price is: ৳ 450. Add to cart

Description

How to Apply for a U.S. Bank Account: Step-by-Step Guide

You can conveniently apply for a bank account in the U.S., and enjoy safe savings facilities and other online banking services. If you are a U.S. citizen or not, learn everything today about opening an account in the USA including which documents to present and how its step by step works into your routine! How to Apply for a U.S. Bank Account

Why Open a U.S. Bank Account?

There are many advantages that come with having a U.S. bank account, particularly if you travel to or have business in the United States often. It makes transfers smoother, often comes with competitive rates and exchange costs on currency transactions,and will even start to establish a financial history if you are a resident or planning to be in the future.

Benefits of a U.S. Bank Account Include:

- Secure Transactions: Protection of funds through FDIC insurance and modern security protocols.

- Access to U.S. Credit System: Important for residents who want to build a U.S. credit history.

- Efficient International Payments: Allows for faster and less expensive transfers for international customers.

Types of Bank Accounts Available

- Checking Account: Ideal for everyday transactions, such as depositing paychecks and making purchases. These accounts usually come with a debit card and check-writing privileges.

- Savings Account: Allows account holders to earn interest on their deposits. Often used for storing money over the long term, it has a limit on the number of monthly withdrawals.

- Certificate of Deposit (CD): Higher interest rates but requires you to leave your money untouched for a specified period.

Requirements for Opening a U.S. Bank Account

There are prerequisites on How to Open a U.S. Bank Account The documentation is different for U.S. citizens, residents, and non-residents with a visa.

Common Documentation for U.S. Residents

- Government-issued ID: Such as a driver’s license or passport.

- Social Security Number (SSN): This is crucial for identity verification and tax purposes.

- Proof of Address: Utility bills or rental agreements are generally accepted.

Common Documentation for Non-Residents

- Passport: Essential for identity verification.

- Visa or Other U.S. Entry Documentation: Shows your legal status in the U.S.

- ITIN (Individual Taxpayer Identification Number): Needed if you do not have an SSN.

- Proof of Foreign Address: Required by some banks.

Note: Not all U.S. banks accept non-residents, so be sure to check bank-specific requirements.

Steps to Apply for a U.S. Bank Account

1. Research and Compare Banks

Consider banks that offer accounts to your residency status, shop around account fees and look at interest rates.

2. Gather Required Documents

You will need to have proof of ID, address and tax id number (SSN or ITIN)

3. Choose Your Account Type

Choose between a checking, savings or another type of account depending on your financial goals.

4. Apply Online or In-Branch

Most banks today allow for online applications, especially if you are a U.S. resident. For non-residents, in-person application may be necessary. The whole process usually only takes a few minutes although verification can take up to 2 business days.

5. Deposit Initial Funds

Most banks will require a minimum deposit, which can vary anywhere from $25 up to$100 This can usually be completed as an online or in-person initial deposit.

6. Account verification and access to online banking

After your account is approved, a banking set-up will be put in place as you access bank statements and view records of transactions to manage all funds online.

Applying as a Non-Resident

They should also check which banks open accounts for foreigners as well, to ensure the process will be successful if they decide on opening one.

Some popular banks that are known for accommodating non-residents include Wells Fargo, Citibank, and HSBC.

Tips for Non-Resident Applicants:

- Prepare for In-Person Visits: Many U.S. banks require non-residents to apply in-branch.

- Obtain an ITIN: While an SSN is typically not available to non-residents, an ITIN serves as an alternative for tax and identification purposes.

Top U.S. Banks for Non-Residents and Residents

Here are some banks that offer convenient account options for U.S. residents and international customers:

- Chase Bank

- Offers comprehensive banking services, including checking and savings accounts.

- Known for a vast ATM network and mobile banking options.

- Bank of America

- Popular for its accessibility and robust online services.

- Offers accounts with low minimum deposits and extensive customer support.

- Wells Fargo

- Provides easy account management and international-friendly services.

- Well-known for its extensive physical branch network.

- HSBC

- Known for international banking options that cater to non-U.S. residents.

- Offers checking and savings accounts specifically for international customers.

- Citibank

- Caters to both U.S. residents and non-residents with a variety of account options.

- Known for its extensive global reach, making it easier for international clients to manage their finances.

Final Thoughts

A U.S. bank account can help you manage your finances for personal savings or day-to-day transactions — and in many cases making money between international accounts easier! Following the steps mentioned in this guide and making sure you have all your documents together can help fast forward the application process, prevent a freeze on your funds, and also open up many services that U.S. banks provide powered by Temenos vsi sdk better than others!

Reviews

There are no reviews yet

Reviews

There are no reviews yet